Explain Different Types of Customs Duty

In recent decades the views on the. One is standard custom duty which is levied at the standard rates prescribed in the schedule.

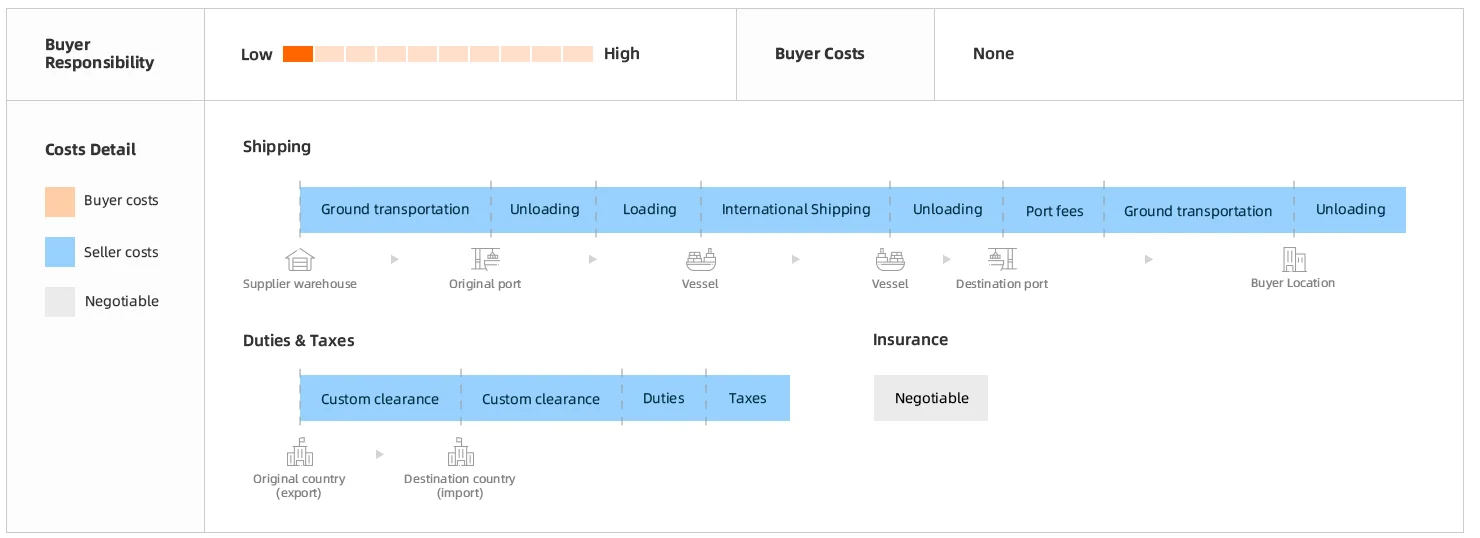

Delivered Duty Paid Ddp Alibaba Trade Terms Explained

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods including animals transports personal effects and hazardous items into and out of a country.

. There are two sub-types of Basic Custom Duty. To take advantage of the Customs duty-free exemption for unaccompanied tourist purchases mailingshipping from an IP or CBI country. An excise duty differs from a customs duty in that an excise duty is imposed on domestically manufactured goods whilst a customs duty is imposed on imported goods.

3 Combined or Compound Duty. Tariffs are a common element in international trading. C Operating in a rule-based system.

For instance there can be a combined duty when 10 of value ad valorem and Re 1- on every meter of cloth is charged as duty. Duties levied on import of goods are termed as import duty while duties levied on exported goods are termed as an export duty. True Countervailing duty or additional duty of customs.

While revenue is a paramount consideration Customs duties may also be levied to protect the domestic industry from foreign competition. Types of Customs Duty Basic Customs Duty. Excise duty is collected on the goods produced by a manufacturer that are to be sold in that particular country.

This countervailing duty is. Customs duties are not levied on life-saving drugs fertilizers and food grains. Most countries require travellers to complete a customs declaration form when bringing notified goods alcoholic drinks tobacco products animals fresh food plant material seeds soils meats and animal products.

The power to enact the. Traditionally customs has been considered as the fiscal subject that charges customs duties and other taxes on import and export. There is another rate which is called the Preferential Rate.

Customs clearance work involves preparation and submission of documentations required to facilitate export or imports into the country representing client during customs examination assessment payment of duty and co taking delivery of cargo from customs after clearance along with documents. Meaning and objects of customs duty Definitions and Concepts Scope and coverage of custom law Types of custom duties Rate of custom duties applicable INTRODUCTION Custom Duty is an indirect tax imposed under the Customs Act formulated in 1962. Additional Countervailing Duty of Customs.

Two types of indirect taxes are excise duty and custom duty. Tariffs are specific taxes paid on items that are classified in a particular class of imports. Type of Custom Duty Types of customs Duties in India.

A customs duty is an indirect tax levied on both imports and exports by customs authorities for international shipments. Up to 800 in goods will be duty-free if it is from a CBI or Andean country. All goods imported into India are chargeable to a duty under Customs Act 1962 The rates of this.

Any additional amount up to 1000 in goods will be dutiable at a flat rate 3. Custom duty is levied on the goods that are imported from other country and are meant to be sold in the country. The Customs Act identifies six methods of customs valuation.

This is levied on imported items that are part of Section 12 of the Customs Act 1962. Anti dumping dutySafeguard duty. Basic custom duty is the duty imposed on the value of the goods at a specific rate.

If on the other hand a country wishes to protect its home industries its list of protected commodities will be long and the tariff rates high. No no it is not. The World Trade Organizations Valuation Agreement is the basis of the requirements of each of these methods.

These taxes are of two types direct and indirect taxes. It is a combination of the specific duty and ad valorem duty on a single product. Countries around the world levy customs duties on the importexport of goods as a means to raise revenue.

So is a customs duty the same as a tariff. Customs duty is a variant of Indirect Tax and is applicable on all goods imported and a few goods exported out of the country. A customs union is an agreement between two or more neighboring countries to remove trade barriers reduce or abolish customs duty Tariff A tariff is a form of tax imposed on imported goods or services.

These rules ensure the value of the imported goods are in accordance with commercial reality and they prohibit the use of arbitrary or fictitious customs values. A customs duty is a tax assessed when importing or exporting. Customs duties are divided into different taxes such as.

Political goals often motivate the imposition or removal of tariffs. In practice this type of duty is mostly levied on majority of items. The tax rate is levied as per First Schedule to Customs Tariff Act 1975.

This is the standard rate at which the Basic Custom Duty is applicable. A Customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory countrys borders. This duty is imposed by the Central Government when a country is paying the.

Import duties are generally of the following types. Tariffs may be further classified into three groupstransit duties export duties and import duties.

Duty Vs Tariff Top 6 Best Differences With Infographics

Customs Duty In India Meaning Types Rates Payment

Types Of Customs Duty In India Indiafilings

Duty Vs Tariff What S The Difference Drip Capital

:max_bytes(150000):strip_icc()/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

The Basics Of Tariffs And Trade Barriers

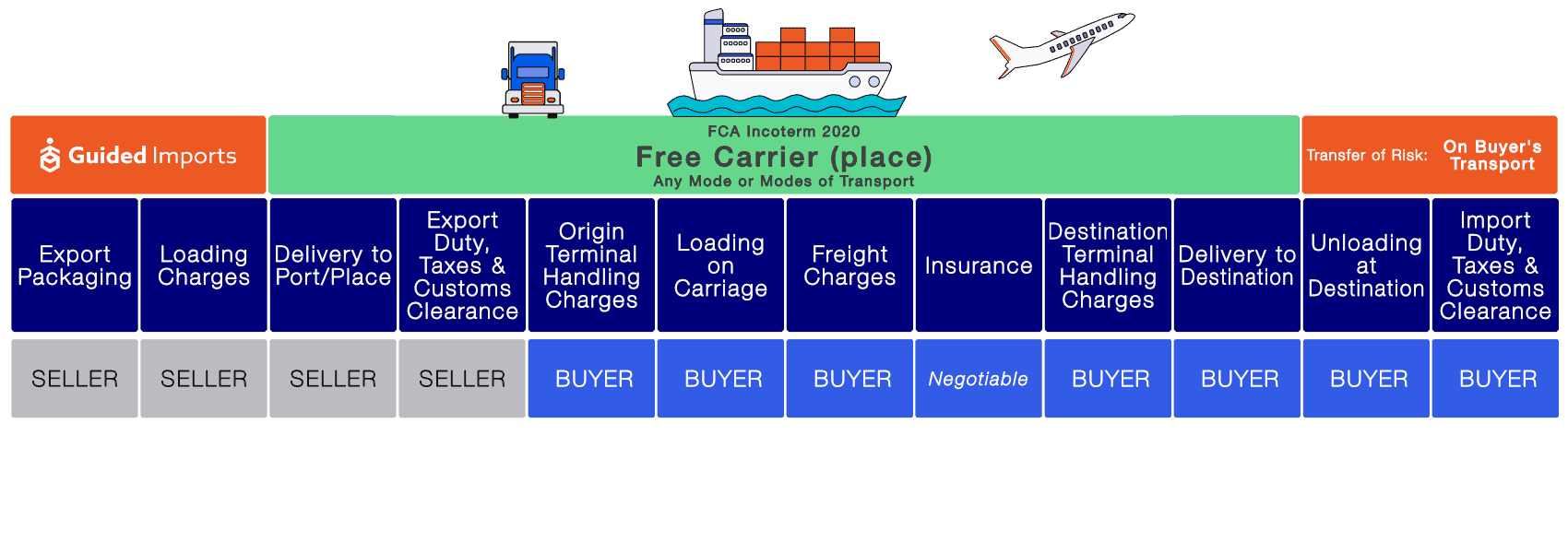

Fca Incoterms What Fca Means And Pricing Guided Imports

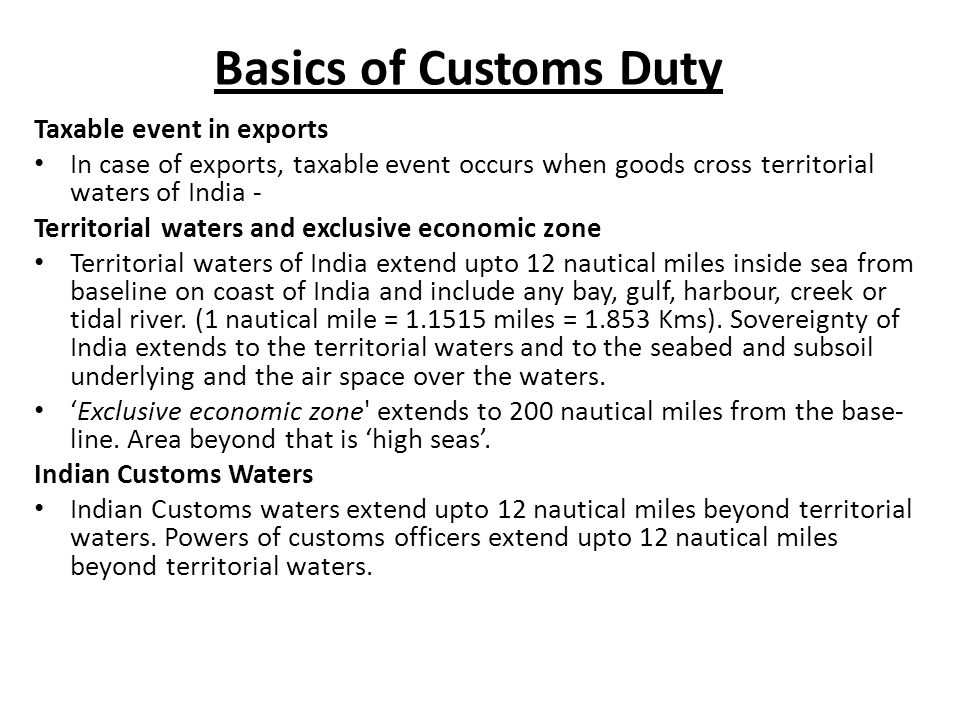

Basics Of Custom Duty Ppt Video Online Download

Basics Of Custom Duty Ppt Video Online Download

/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

The Basics Of Tariffs And Trade Barriers

What Is Customs Duty Customs Duty Definition Customs Duty News

Basics Of Custom Duty Ppt Video Online Download

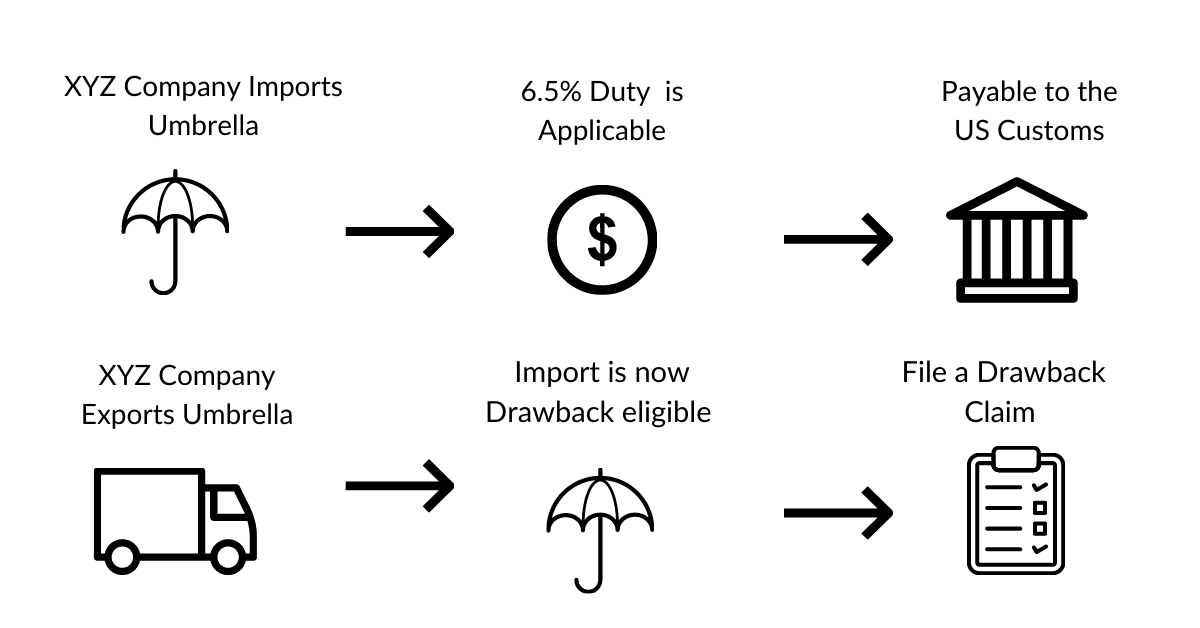

Duty Drawback Meaning Types Process More Drip Capital

Duty Vs Tariff Top 6 Best Differences With Infographics

Basics Of Custom Duty Ppt Video Online Download

Explaining Customs Clearance In 4 Easy Steps Easyship Blog

Comments

Post a Comment